The concept of FTWZ (Free Trade Warehousing Zone) was introduced in India in 2007 to promote exports, boost foreign investment, and enhance the country’s competitiveness in the global market. These zones offer various incentives such as tax exemptions, simplified customs procedures, and streamlined regulatory requirements to attract domestic and foreign companies.

FTWZs are Deemed Foreign Territories / Ports / Warehouse for Storage and Other value added activities under the Customs Law. FTWZ units are allowed to hold inventory on behalf of Foreign Suppliers/ Domestic Buyers. One of the key advantages in contest of units of FTWZs to hold inventory for longer periods of time, without paying any duties or taxes. This allows businesses to maintain a buffer stock of raw materials or finished goods, which can be quickly dispatched to meet customer demand. It allows multiple transfers of ownership transactions without removal of the goods out of FTWZ, thus ensuring the trading chain to be as close as possible and as may be required, ensuring that there is no cascade of indirect taxes / compliance and avoids increase in transaction cost.

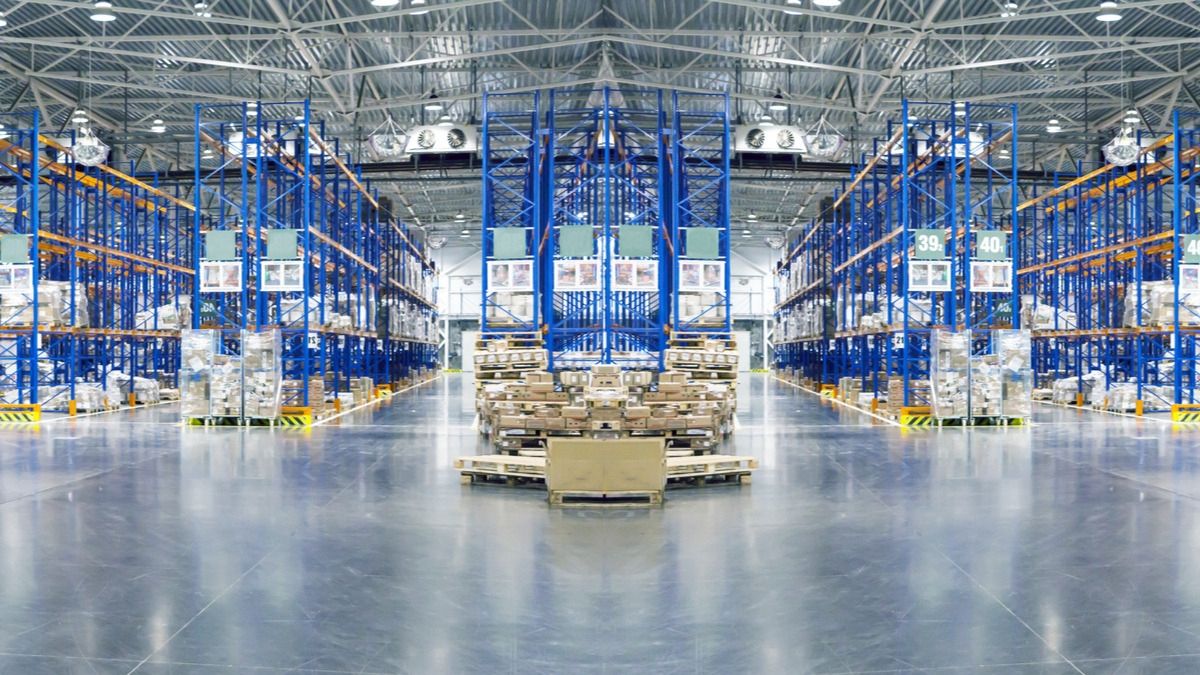

FTWZs are designed to cater to the needs of export-oriented industries and international trading companies. They provide a one-stop-shop for all logistics requirements, including storage, handling, transportation, and value-added services. The infrastructure in FTWZs is designed to meet international standards, with state-of-the-art facilities such as modern warehouses, cold storages, container yards, and customs clearance facilities.

Accelerate SeZ Logistics is one of the leading professions with rich experience in providing Special Economic Zones (SEZ) and Free Trade Warehousing Zone (FTWZ) solutions to our units/customers.

Some of the key benefits of SEZ-FTWZ in India are as follows:

Tax incentives: SEZs offer several tax incentives to businesses, including exemption from income tax, corporate tax, and other taxes for a specified period of time. This can help businesses reduce their costs and increase their profitability.

Duty-free imports: SEZs allow businesses to import raw materials, machinery, and other goods duty-free, which can help them reduce their production costs and improve their competitiveness.

Streamlined regulations: SEZs offer a streamlined regulatory framework, which can help businesses reduce their administrative burden and speed up their operations.

World-class infrastructure: SEZs offer world-class infrastructure, including modern warehouses, transportation networks, and other facilities, which can help businesses operate more efficiently and cost-effectively. Overall, SEZs in India offer several benefits to businesses, including tax breaks, duty-free imports, streamlined regulations, and world-class infrastructure, which can help them increase their competitiveness and expand their operations.